1 in 5 homes in the US recently sold were foreclosed and bank owned, according to CNN. I looked at recent sales in the Eugene Springfield area, and we are faring better. In the last month, about 1 in 10 sales of houses were bank owned (11%), and about 1 in 10 (9%) were short sales. Why? Perhaps because our market didn’t rise or tank to such extremes as others in the country.

Real Estate Resource

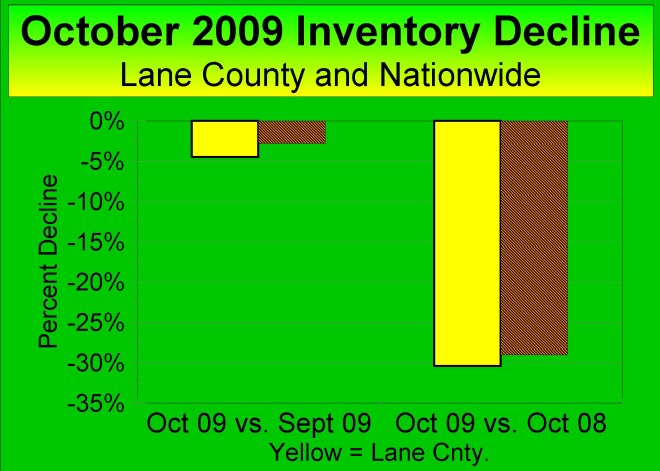

Housing inventory down in October

The supply of houses, listed for sale nationwide, fell by 2.8% in October. Normally, house supply increases by 1% in October, due to a seasonal slowdown in the market. Nationwide, October of this year had 29% fewer houses listed for sale than October 2008.

In Lane County, we fared even better with an October decline of 4.5% from September 2009 levels. October of this year was down 30%. The larger the decline, the better the market. The decline in inventory is due to cheaper prices and the government tax credit, I suspect.

Cause of Housing Crisis: DC

So what caused our housing meltdown, which started in 2007? The short answer is policies from Washington, D.C. As a realtor, I occasionally get heat from people saying that I and my fellow realtors are responsible. Other mistaken villains are builders and bankers. Wall Street’s culpability is somewhat less clear.

Two excellent editorials pin the start of the problem on the 1992 GSE Act, which led to the issuance of more sub-prime loans, which as we all saw, default more. The goal of the act was a greater proportion of home ownership; that may or may not be achieved given the high rate of foreclosures.

So, what’s the eventual outcome? Housing will recover as will the economy. It’s just a question of when.

I recently represented buyers in the purchase of this foreclosed home. We got it for 81K, and from showing to closing it was under a month. If you’re interested in foreclosures in Eugene Springfield, give me a call at 517-6543.

Will the FHA tighten home loan standards?

Perhaps. They’ve already boosted required down payment to 3.5% in the last year, but remain one of the easiest sources of home loan money. An article in yesterday’s WSJ said that current delinquencies on FHA loans were up from last year by about 1/2 to 7.8%.

FHA is required by Congress to maintain cash reserves of at least 2% of the loans it insures. Reserves were 6.4% in 2007, 3% last year, and is expected to be less than the required 2% when those numbers will be published this September 30.

So, what will happen? Maybe increased down payment. Maybe increased oversight and regulation at FHA and FHA loan originators. Maybe another bail out. But, probably not anything that will help people get loans.

Below is a house I recently sold that went FHA. Payments were a bit over 1K per month for this cool home. As I’ve said before, now is a great time to buy a house.

July’s home sales were up

Home sales, in number of units sold, were up for the fourth straight month in July, According to the NAR. Increases for four months in a row hasn’t happened in five years. Nationwide, we’re on track to sell 5 1/4 million pre-existing houses this year. July’s increase over June’s, at 7.2%, was the largest in a decade.

Home sales popped up in July 2009

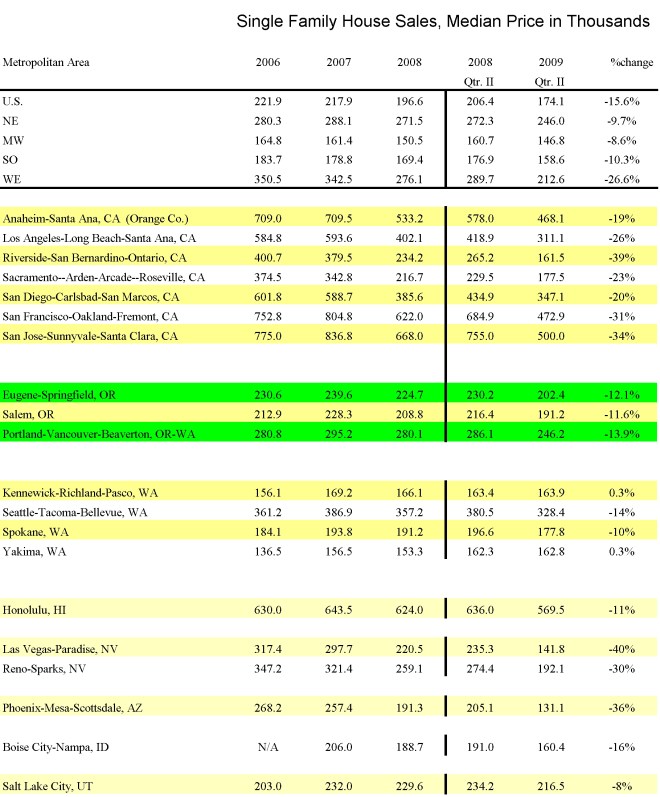

Houses prices in the West

The National Association of Realtors has a neat site where you can compare the prices of houses sold for different U.S. Metropolitan areas. It also lists average commute times; the value of that is a bit of a mystery to me, but it’s mildly interesting.

In the chart below, I show median single family house prices for some Western cities. The average price drop across the nation for second quarter 2009, compared to the same time period last year was 15.6%. All of the cities listed in California did worse. As did Nevada.

Oregon and Washington fared better than the national average. The average decline for the Oregon Cities was: Portland 14%, Eugene 12%, and Salem at 11 ½ %. While the decreases are notable, the bottom didn’t fall out in these markets. Conventional wisdom is that because the Willamette Valley didn’t see the run up in prices at market peak, we had less of a correction at market bottom.

Median house prices of selected western cities. Q2: 2009.

Owning vs. Renting

Most people intuitively know that it’s better to own a house instead of renting a place. The NAR recently looked at the data and found that the net worth of home owners exceeds that of renters by a factor of 50 to 1, with the main difference being home equity. 50:1 – wow.

There are still plenty of affordable good buys out there. This house was in a quiet neighborhood and was in the 160’s. It’s been remodeled and is on a large lot, and subsequently sold.

If you’d like information on affordable homes in Eugene Springfield, give me a call at 517-6543.

Another affordable house in Eugene Springfield.

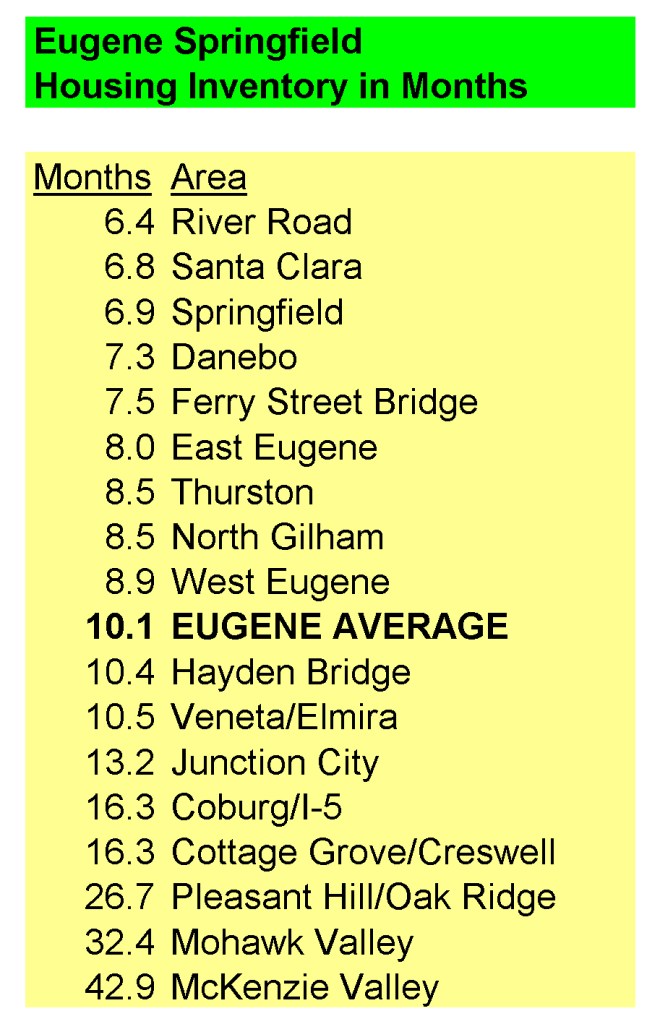

Eugene Springfield Housing Inventory

I looked at housing supply by area for Eugene Springfield. A six month supply is said to be a balanced market. Less than 6 is a seller’s market, and greater than 6 is a buyer’s market. Areas with modestly priced housing stock that are closer to town are doing the best. The original data came from June 2009 rmls. My analysis is below.

June 2009 Housing Inventory

Housing in Eugene More Affordable

3727 Megan: 156K.

Houses have come down in price and are becoming increasingly affordable. The house below was a listing of ours. It’s at 3727 Megan Way in Eugene, Oregon. It’s 2 bed, 1 bath and 8 years old. Now here’s the best part: It was listed at only 149K. Principal and interest should be about $800 per month. So, it’s very affordable.

If you’d like information on affordable housing, give me a call at 517-6543.

Home Building Increases

Housing starts are up Nationwide and in the West, improving for over the last three months. Single family starts, nationwide, jumped over 14% from last month to 470,000 annually in June, 2009. This was the biggest monthly gain in 4 years, according to the WSJ. Home building in Eugene is improving, but is not brisk. If you’re wanting to build a house, now is a great time to do so.

Annualized Housing Starts Continue to improve in 2009

Nationwide (top) and Western (bottom) housing starts.